Economic shifts

Increase the resiliency of financial systems

Post-crisis renewal of financial regulation: stability and resiliency of financial systems are the focus of intense standards activity in Europe

The 2008 financial crisis was so serious, it actually reversed the previous decades’ trend of gradual deregulation of financial activities and entities. Political will, led at an international level by the G20, has given birth to a dense body of new rules aiming to secure the markets and, ideally, keep new crises from happening or at least keep them from getting out of hand.

Banks were already on the way to recovery in 20091, but the real economy did not recover as fast from the crisis. In the euro zone the unemployment rate surged from 7.3% before the crisis to 11.1% in May 20122. In

October 2012, the European Union had 24.7 million unemployed persons, including 10.3 million long-term3.

As the financial sector’s vulnerabilities inflicted long-lasting damage to the global economy, it became a focus of policy-makers. In the midst of the crisis, the G20 became the go-to body for international economic and financial coordination. The London summit of April 2009 instituted the Financial Stability Board (FSB) and mandated it to issue recommendations to reform the financial systems.

The United States decided to adopt the FSB’s recommendations all at once, in the form of the Dodd Frank Act in June 2010, but the European Union segmented it into several “packages” including directives and/or regulations.

The vast reform programme pursued several objectives, including making the markets safer, enhancing investor-consumer protection, transforming the shadow banking system, and making financial institutions more resilient.

It is this last objective that is the subject of this article, particularly the complex regulatory architecture that the European Union has built up for this purpose.

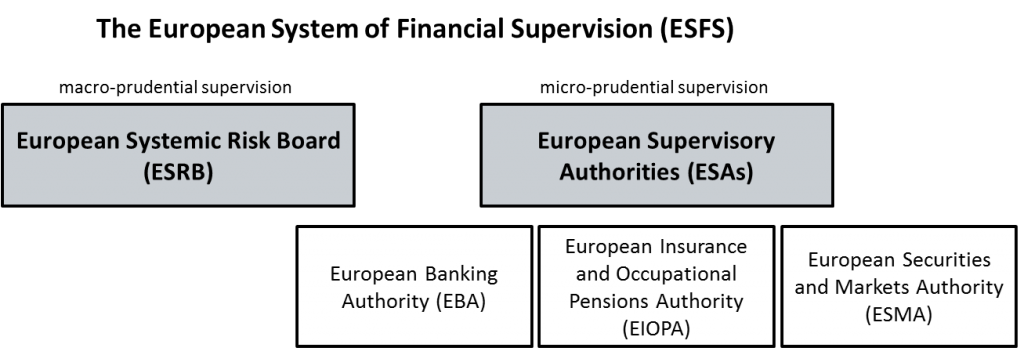

The European System of Financial Supervision (ESFS) is the cornerstone of this edifice.

Introduced in 2010 in the form of the “Supervision Package” (with five regulations and one directive), it gave form to the recommendations issued the group of experts chaired by Jacques de Larosière and mandated in October 2008 by the European Commission to reflect on a framework for reinforced financial supervision that is better coordinated on a European scale. The Larosière report considered that such a framework must be based on a dual, macro-prudential/micro-prudential and supranational/national axis.

The ESFS consists of several entities. The European Systemic Risk Board (ESRB) is in charge of macro-prudential supervision of the financial system with the objective of identifying and preventing systemic risks. Its role is to review the European financial system on an ongoing basis and to issue recommendations and/or alerts as soon as it sees common weaknesses that could spread throughout the system and harm the rest of the economy.

Three authorities handle micro-prudential supervision of establishments and aiming to protect consumers: the European Banking Authority (EBA), European Insurance and Occupational Pensions Authority (EIOPA), and European Securities and Markets Authority (ESMA). These three European Supervisory Authorities (ESA) submit draft technical standards that the European Commission adopts, adding them to the regulatory package in the form of delegated acts or executive acts. They are also in charge of publishing guidelines and recommendations for national regulators and arbitrating differences between them.

These ESAs thus contribute to harmonisation and consistency in financial supervision within the EU and ease coordination between various national authorities, who are represented on each of the three authorities’ decision-making bodies.

The European supervisory framework has been enhanced significantly by ESFS, but it can, and will be, improved further

Some changes are likely to come from the Capital Markets Union project, which was announced by the Commission in 2015 in the form of a 33-point plan to implement by 2019. The goal is to deepen the integration of capital markets throughout the EU through legal acts in various fields or through private-sector initiatives.

The Capital Markets Union provides backing for the “Investment Plan for Europe”, which was announced in 2014 and named the “Junker Plan” after the president of the European Commission, and which aims to boost investment in the EU by raising 315 billion euros from private and public sources from 2015 to 2018.

Free circulation of capital was among the EU’s founding principles, but European capital markets are still fragmented and overshadowed by the traditional bank lending, which is firmly entrenched in Europe. The Capital Markets Union’s main objective is to further disintermediate financing of economic activity, which would allow European companies, smaller ones in particular, and savers to diversify their investment opportunities.

Enhancing the stability and resiliency of the European financial system is an integral part of the construction of the Capital Markets Union. The enhanced integration of European financial systems naturally requires enhanced systems of supervision, as they are likely to spread and accelerate negative shocks between member-states. As financial regulation is still mostly in the hands of national authorities, unsuitable or ineffective supervision by one member-state could create a risk in other member-states.

This is why the Commission identified the creation of a single capital markets supervisor as a challenge of the greatest importance. The initial stages will be within a reform of ESFS, and will consist mainly in strengthening ESA prerogatives to, perhaps, conducting independent audits on the activity of national authorities. Their governance could also be reformed to include independent members on their decision-making bodies alongside national representatives and expressing supranational views.

Regarding ESMA in particular, the Commission is considering extending its direct supervisory prerogatives, which for the moment are limited to ratings agencies and central repositories, to the approval of some prospectuses and the monitoring of investment funds subjected to a harmonised regime at the European level, i.e. European venture capital funds (EuVECA), European social entrepreneurship funds (EuSEF) and European long-term investment funds (ELTIF).

The banking issue: The creation of the Banking Union in 2012 also introduced some changes in the ESFS architecture.

It addressed the need to establish a decision-making process that is common to the entire EU and that with more ambitious tasks than merely coordinating the actions of national supervisory authorities. The thinking behind this is that the introduction of a single currency under the Economic and Monetary Union (EMU) led to very deep economic and financial integration within the euro zone, bringing on it heightened risk of cross-board spread of a banking crisis.

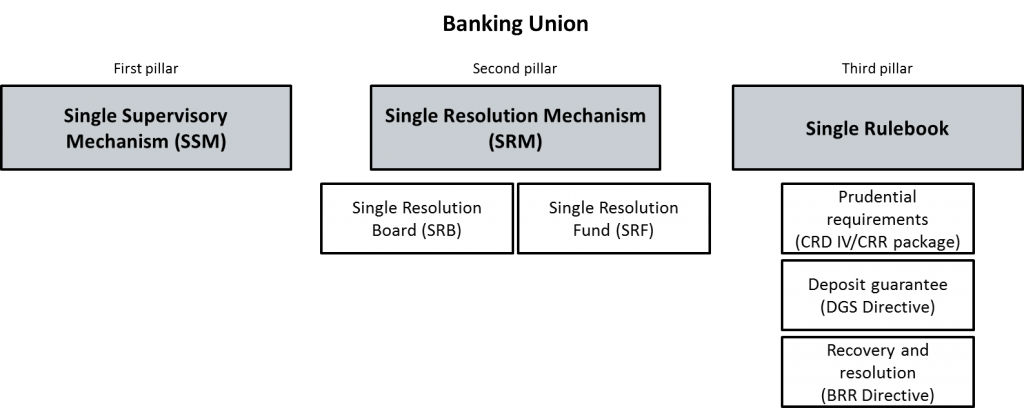

The Banking Union was therefore designed as a prudential system of controls and resolution of banks at the EU level. It covers all euro zone countries, as well as EU member-states that have chosen to take part.

It is built on three pillars. The Single Supervisory Mechanism (SSM) is the first of these. Its main objectives are to work towards stability and solidity in the European banking system, in order to enhance its integration and ensure consistent supervision of it. The European Central Bank is playing a first-tier decision-making role in this.

The second pillar is the Single Resolution Mechanism (SRM), which aims to implement efficient procedures for resolving distressed banks The SRM itself consists of a Single Resolution Board (SRB), which oversees the proper execution of these procedures, and the Single Resolution Fund (SRF), which provides it with financing (the SRF is funded by contributions from the banking sector).

The SSM and SRM are both backed by a single regulatory package, or Single Rulebook, which embodies the third pillar of the Banking Union and aims to eliminate divergences between national legislations in order to guarantee equal consumer protection in all member-states and fair competition for banks.

Applicable to all EU banking establishments, the Single Rulebook is the foundation of the Banking Union. It contains rules pertaining to minimum capital requirements (CRD IV and CRR), national deposit guarantee systems (DGSD directive), and bank recovery and resolution (BRRD).

The CRD IV/CRR package, applicable since 1 January 2014, introduces into European law the international standards of the Basel III agreement. Prudential requirements in the areas of equity, liquidity and credit risk were strengthened after the crisis in order to enhance banks’ capacity to withstand economic shocks, enhance their risk management, and maintain lending activity during economic slowdowns.

A bank’s capital is expressed in a percentage of risk-weighted assets. The riskier its assets, the more capital provisions the bank must set aside. The general rule is that the total amount of capital held must be equal to at least 8% of risk-weighted assets. Within this amount, higher-quality capital (i.e. “Core Tier 1”, or category 1, capital in Basel III terminology) must be equal to at least 4.5% of risk-weighted assets.

On top of this general rule, there are “capital buffers”. Among these the countercyclical buffer aims to mitigate the economic cycle’s effects on bank lending activity, by requiring that they accumulate Tier-One capital during phases of fast expansion in lending. The buffers can then be freed up during economic slowdowns to allow banks to continue lending to the real economy.

The ambitious CRD IV/CRR prudential package also includes liquidity requirements, meaning that banks must hold a sufficient short-term liquid assets to cover their cash outflows, and they must publish their leverage ratio (i.e. the ratio between a bank’s assets and its capital).

The system of deposit guarantees covered by DGSD, which came into effect in June 2014, aims to protect depositors in the event of a bank failure and to harmonise the level of protection at the European level. Organised within each member-state, they refund depositors up to €100,000 per bank within 20 days, gradually reduced to seven by 2024. The guarantee is meant to prevent massive withdrawals of deposits, known as “bank runs”.

A European-level deposit protection system is one of the main projects in progress for deepening and completing the Banking Union. It would then become one of the pillars, alongside supervision, resolution and single regulatory package.

With this in mind, the European Commission in November 2015 released a draft regulation, the European Deposit Insurance Scheme (EDIS), which is subject to final approval from the European Council and Parliament. National systems would be supplemented with a European deposit insurance fund, equivalent by 2024 to 0.8% of the deposits covered under the Banking Union.

And, lastly, BRRD, a directive adopted in 2014, established a framework for recovery of distressed banks and resolution of defaulting banks. One of BRRD’s flagship measures is the introduction of the “bail-in” concept, in which a defaulting banks’ liabilities are cancelled or reduced or its debts are converted into equity in order to absorb its losses. “Bail-in” is considered the opposite of “bail-out”, which is the recapitalisation of a bank by injecting public funds into it.

It is designed to address the issue of the budget cost of bank failures, as well as the moral hazard of banks said to be “too big to fail”. The internal recovery mechanism is a change in paradigm, as it means the state will no longer be the payer of last resort, and it would thus encourage greater discipline by banks.

Even so, some of its procedures and the effects it produces have come under criticisms, for example that it could be counter-productive by spreading one bank’s problems to the entire financial system by applying to contagion-prone liabilities. Other say its internal recovery mechanism is too small and charge that it will inevitably have to call on public funding. In any case, the bail-in mechanism must still prove itself and its procedures are expected to evolve in the direction of greater efficiency.

Also regarding bank sector reforms, there is one outstanding question on the European level: ring-fencing retail banking off from investment banking in order to protect the former’s assets from the latter’s risks.

The United States was the first to take on this issue. The “Volcker rule”, which is in the Dodd Frank Act of 2010, prohibits proprietary trading by banks and bans them from relationships with alternative investment funds. This is a major turnabout in that it brings back the principle of the Glass-Steagall Act of 1933, which had been revoked by the Clinton administration in 1999 under pressure from the banking sector.

In Europe, an expert committee chaired by the governor of the Bank of Finland, Erkki Liikanen, released a report in 2012 advocating such ring-fencing. The report has not yet been translated into European law but has inspired some initiatives on the national level.

France, for example, adopted a banking law in July 2013 requiring that activities not regarded as useful for the economy (i.e. speculation) be placed into dedicated subsidiaries that are entirely separate from the rest of the group.

But the law has come under some criticism, as the perimeter of activities regarded as speculative looks very small, with a limited volume of transactions within banking establishments. The French position is therefore less rigid that the positions of the US or the Liikanen report, but does have the advantage of not pushing speculative activities into the sphere of the shadow banking system.

Post-crisis reforms have added a large number of new rules, mainly in the direction of banks. But regulators have also targeted the insurance sector, which is also a potential source of systemic risk.

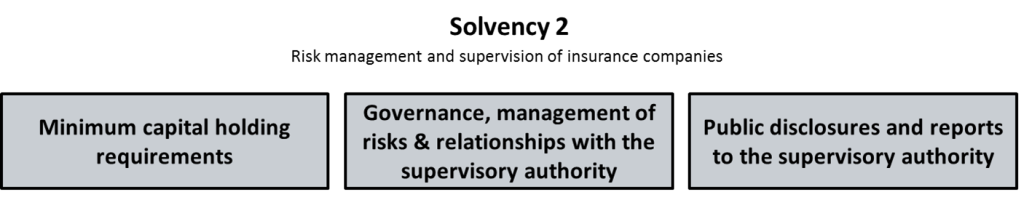

The Solvency II directive, which has been fully applicable since 1 January 2016, lays out a harmonised prudential framework to strengthen risk management and supervision of insurance companies and replaces the 14 directives of the pre-existing system. It applies to all insurance segments, including life insurance (designating the way capitalisation premiums are managed), non-life insurance (where premiums are managed by mutualisation) and reinsurance.

So Solvency II is to insurance companies what the CRD IV/CRR package (transposing Basel III) is to banks. It sets up a three-pillar system.

The first sets the minimum capital holding requirements and identifies the assets eligible for meeting these requirements, which are on two levels: the Minimum Capital Requirement (MCR) and the Solvency Capital Requirement (SCR). The first is the minimum amount of equity capital below which the supervisory authority may decide to revoke the insurance company’s certification. The SCR is the minimum amount of capital (higher than the MCR) that an insurance company must hold in order to absorb significant losses and maintain payments to insured parties.

The second pillar of Solvency II is qualitative in nature, in that it covers the governance and management of risks within insurance companies, as well as their relationships with the supervisory authority in the exercise of its prerogatives.

The third pillar provides for public disclosures and reports to the supervisory authority allowing it to conduct its mission. Together, these three pillars aim to guarantee that an insurance company can maintain its activities during difficult phases, and to protect its policies holders.

Since the financial crisis of 2008 began, the European Union has adopted more than 50 legal acts making resiliency of European financial systems a priority of its standards activity. So much so that a new era seems to have begun, one that is distrustful or reluctant to embrace the long-standing principle of self-regulation by the markets, and preferring actual regulation. However, this era will not be one of mistrust of finance itself, as the European legal edifice is geared not to limitation but to expansion, in that it supervises finance so that it can develop even further, but on more healthy and solid foundations.

How can the effectiveness of these reforms be assessed? Certainly, during a future crisis, of which they may be able to limit the seriousness if they are unable to prevent it outright. This will tell us if the choice of integrated regulation was taken far enough to allow regulators to coordinate their actions, if prudential requirements were sufficient to ensure the solvency of systemic institutions and the continuation of their activities that are most essential to the economy, if deposits have been protected and state finances preserved, and so on. In short, if the financial system has proven its resiliency.

— Pauline Marteau, Marketing, CPR AM